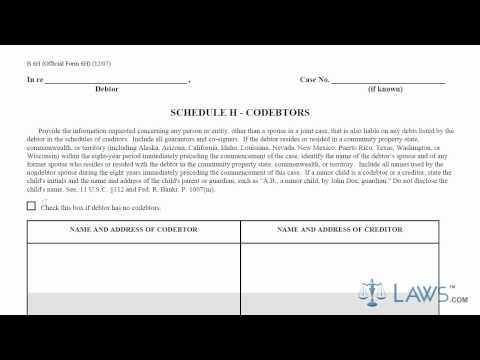

Laws.com legal forms guide will help you complete a bankruptcy form Schedule H4 Co-debtors. It's important to have clear instructions to streamline the filing process. However, it is recommended to have a bankruptcy attorney assist you before filing Schedule H. Before completing the form, you should understand what a co-debtor is. A co-debtor is an individual with whom you share a debt. For example, if you bought a car or a house, the co-debtor acts as your cosigner. Co-debtors are usually offered certain protections when the debtor files for bankruptcy. Additionally, they may receive credit for payments made by the debtor on a debt during the bankruptcy case. To complete Form B-6H, you must provide information about any and all co-debtors to the trustee and the creditor. A co-debtor refers to an individual in a joint case who is liable for all debts listed by the debtor in the schedules of creditors. If you don't have any co-debtors, you can proceed to the next schedule. Schedule H is a basic two-column form in which you provide personal and basic information about your co-debtor in the first column, including their name, address, and date of birth. In the next column, you list all information about the type of debt the cosigner took on for you. This includes the amount of the debt, the type of debt, the date it was agreed to, the amount unpaid, and any other relevant details about the particular debt. If the co-debtor is not your spouse or if they co-signed a piece of property for you, you should mention it in this section. For more instructional videos, visit laws.com.

Award-winning PDF software

Schedule H 1120 Form: What You Should Know

Note that section 528(c) does not require that the business income be allocated to each of the PCI and FONGECI companies as a percent of the aggregate PSC profits. You must allocate your business income for the year to the PSC's.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule H), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule H) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule H) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule H) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule H 1120